If you’re interested in the Personal Capital Advisors you’ll get personalized investment management and planning and financial advisor access, for a fee. Personal Capital also analyzes your investment fees and asset allocation and offers helpful suggestions for improvement.Īs an added bonus – users can also use Personal Capital as a robo-advisor.

#Import quicken mint free#

The free Personal Capital app provides updates to bank and investment accounts, spending, portfolio performance, investment allocations, sector weightings and your home value. Sign up and linking accounts is quick and easy! Whether you use Quicken or not, why not sign up for the FREE Personal Capital financial planning tools? The free Personal Capital dashboard is a comprehensive investment tracker to monitor your own investments and compare them with the market! Personal Capital goes beyond simply calculating what percentage of your budget was spent on Starbucks this month, and gives detailed retirement predictions based on your investments, goals, and lifestyle changes.

#Import quicken mint software#

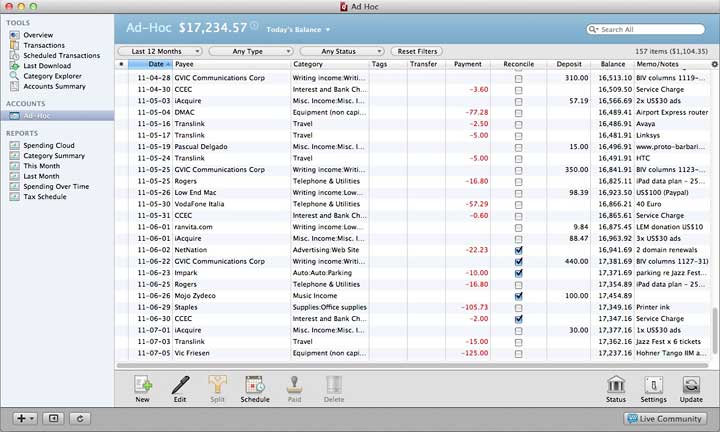

Personal Capital is also a free budget app that is easy to use if you’re looking for something simple, but with the many other features and calculators, this software might be most beneficial to someone with active investments. Mint is ideal for the younger adult or those just beginning to manage their money. You can create budgets, track investments and learn ways to save. Mint, like the other platforms, lets you know what you have, what you owe and where you can cut back. The software is essentially autonomous once you connect all your financial accounts, although occasionally (very rarely!) accounts do not sync automatically-a bit of a glitch that is more annoying than detrimental to your financial success. If you’re looking for an easy-to-use, free budget app, you can’t go wrong with Mint. Quicken Review with a focus on your specific money-monitoring needs. Although, since Personal Capital is free, you might use both! If you’re willing to pay an annual fee, then Quicken is a solid Personal Capital alternative. We like to budget in Quicken and track expenses and income by category! The Quicken personal budget app offers in depth financial analysis and comparisons with average spenders. Since Personal Capital and Mint are free and easy to access, they move to the top of our list.Īlthough, if you want extensive reports and customization, then Quicken can be worth the money. The right financial app for you depends on your needs and wallet. No software to install-easy viewing on a browser.Recommendations for financial services that are tailored to your financial situation, such as credit cards and debt consolidation companies.Easy budgeting and help creating a budget you can stick with.Quicken Review will help you understand the similarities and difference between these three financial management apps and decide which one(s) are for you.

Quicken, you should first know that the three platforms, while they have many overlapping features, are actually quite distinct and have the capacity to serve very different purposes. An investment management platform (Quickekn or Personal Capital).An in-depth financial log to make filing taxes a breeze (Quicken).Yet not all platforms are created equal! Depending on your financial needs, you might be looking for: Quicken-Overviewįinancial management software is an effective way of quickly keeping an eye on your budget, spending, and investments. *Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. Can Personal Capital Import Quicken Data?.And those seeking basic budgeting, will examine the Mint vs. Quicken comparison that more sophisticated investors will likely prefer Personal Capital or Quicken (or both!). You’ll find that through this Personal Capital vs.

Personal Capital choice is a trickier comparison. While Quicken was around way before Mint and Personal Capital, the latter are now viable free Quicken alternatives.Īnd if you’re only seeking the best budgeting apps, then focus on Quicken vs.

This article compares three top financial management tools-Personal Capital, Mint, and Quicken-to see which financial tracking system is right for you! A quick Google search for “best budgeting methods” will net you over 32 million results-so where should you start?Īlthough a pen and paper budget will do just fine in a pinch, there are now many electronic financial management options available with advanced features, investment options, and more. The key to a healthy financial life is knowing where your money is at all times.

0 kommentar(er)

0 kommentar(er)